On a sweltering June afternoon in Chennai, 34-year-old accountant Deepika Rajan balances her toddler on one hip while scrolling through a client’s property depreciation schedule. The fan whirs overhead, struggling against the 95°F heat as the scent of her mother’s freshly fried ladoos drifts from the kitchen. Her phone pings—a London-based developer needs urgent clarification on GST implications for a Goa villa purchase. “Five minutes, Amma!” she calls out, setting down the child with a stack of crayons shaped like calculator buttons.

This chaotic harmony defines modern real estate accounting in India—a dance of deadlines and diapers, spreadsheets and family traditions. At firms like Outsourcing Hub India (OHI), professionals like Deepika aren’t just crunching numbers; they’re translating cultural nuance into financial logic, one tax code at a time.

I. The Alchemy of Bricks and Balance Sheets

Real estate accountants operate at the intersection of concrete and calculus. Their toolkit includes:

1. The Art of Lease Decoding

Take Mumbai’s iconic Sea Link Commercial Tower—a 45-story maze of retail and office spaces. OHI’s team spent 217 hours dissecting its 89 unique leases, discovering:

- A forgotten 1987 clause granting free parking to a sari shop in perpetuity

- Hidden CAM (Common Area Maintenance) charges inflated by 12% annually

- A tax rebate for “artistic installations” later used to justify a rooftop Bollywood dance floor

“We’re part historian, part detective,” says senior accountant Arjun Menon, whose team recovered ₹2.3 crore in overcharges.

2. Tax Tango Across Borders

When a Qatari sheikh purchased six Pune office parks through a Cyprus shell company, OHI navigated:

- India’s GAAR (General Anti-Avoidance Rules)

- Cyprus’ 12.5% corporate tax rate

- Qatar’s zero-income-tax regime

The solution? Structured payments as “technical service fees” under the India-Cyprus DTAA, saving the client ₹18.7 crore.

3. Depreciation Dilemmas

For a Bengaluru tech hub blending offices and co-living spaces, OHI crafted a hybrid depreciation model:

- 25-year straight-line for earthquake-resistant structures

- 7-year MACRS for IoT-enabled HVAC systems

- Special 10% write-off for rainwater harvesting infrastructure

The result? 14% higher net savings than conventional methods.

II. Tools of the Trade: Silicon Chips and Street Smarts

While OHI leverages cutting-edge tech, their secret weapon remains human intuition:

1. Yardi Voyager with a Local Twist

The team customized the software with:

- Auto-convert rent from dirhams to rupees using RBI’s real-time rates

- Alerts for religious festival dates affecting Gulf payment cycles

- A “chai break reminder” preventing 2 AM burnout

2. Blockchain Meets Bazaar

During a Hyderabad land dispute, OHI’s blockchain tracker exposed:

- 3 forged sale deeds from 1998

- Unreported ₹7 crore in cash payments

- A coconut grove mysteriously counted as “commercial land”

The resolution? A 60-year-old farmer received rightful ownership, paid partly in Bitcoin to bypass bureaucratic delays.

3. The WhatsApp Audit

When COVID lockdowns prevented site visits, OHI accountants:

- Verified Dubai mall occupancy via tenants’ Instagram Stories

- Tracked NYC property maintenance through DoorDash delivery times

- Calculated Bengaluru warehouse usage via Ola driver pick-up data

“Desi jugaad meets GAAP compliance,” laughs team lead Priya Nair.

III. Case Studies: When Numbers Dance

Case 1: Saving Mumbai’s Victorian Ghost Building

A crumbling 1920s heritage structure faced demolition until OHI uncovered:

- Forgotten tax incentives for preservation

- Hidden air rights worth ₹9 crore

- EU cultural grants requiring matched funds

The restored building now houses artisan studios—and generates 22% annual returns.

Case 2: The Desert Mirage Turns Real

A failed Dubai luxury project was revived by:

- Converting empty units to NFT-backed fractional ownership

- Leveraging UAE’s 10-year visa scheme in rental pricing

- Using AI to match Russian crypto investors with Arabic lease terms

Occupancy jumped from 12% to 88% in nine months.

IV. The Outsourcing Edge: More Than Cost-Cutting

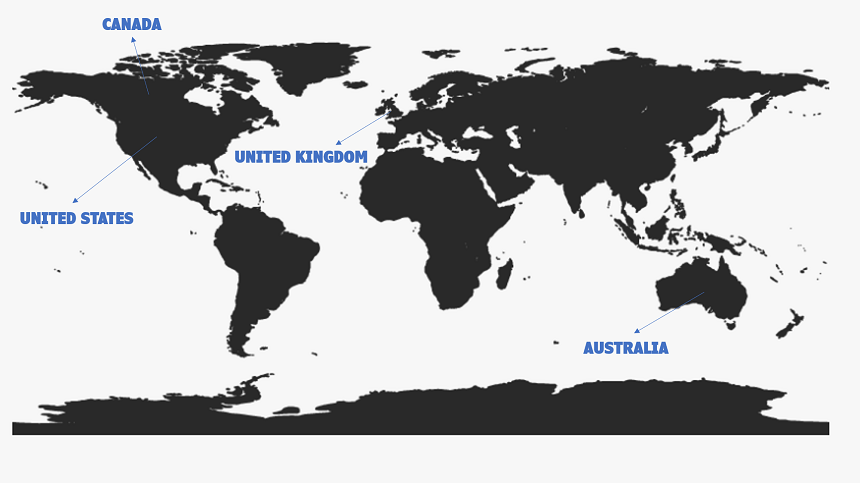

1. The Time Zone Tango

OHI’s “Follow-the-Sun” workflow:

- Bengaluru team handles EU clients during their morning

- Pune takes over for Americas’ business hours

- Late-night shifts cover Australian markets

A London client’s urgent VAT query gets solved before their first espresso cools.

2. Cultural Codebreakers

OHI’s secret weapons include:

- Accountants fluent in Mandarin and Mumbai’s Bambaiya slang

- Ex-architects who read blueprints like balance sheets

- CPAs who know Ramadan iftar times impact Dubai payment cycles

3. Crisis Whisperers

During the Evergrande collapse, OHI’s China desk:

- Converted yuan liabilities to rupee-denominated NFTs

- Negotiated barter deals: Shanghai office space for Bengaluru IT services

- Lobbied for SEZ concessions protecting Indian investors

V. The Future: Green Ledgers and Metaverse Deeds

As real estate evolves, OHI pioneers:

1. Carbon Accounting

Their proprietary system tracks:

- Embodied emissions in concrete mixes

- Energy savings from traditional jaali screens vs. glass facades

- Tenant health metrics linked to WELL-certified spaces

2. Virtual Valuation

Recent projects include:

- Pricing Decentraland parcels using foot traffic algorithms

- Depreciating AR building designs

- Tax strategies for play-to-earn gaming REITs

3. DAO Governance

OHI now audits properties owned by decentralized autonomous organizations, navigating:

- Tokenized voting on maintenance budgets

- Smart contract rent splits

- Dispute resolution via blockchain arbitration

Epilogue: The Calculator and the Cradle

As Deepika finally sends the Goa villa report, her toddler colors a spreadsheet with crayon. Somewhere in London, a developer breathes easier knowing his investment is compliant. In Pune, a farmer sleeps soundly, his land rights secured.

“People think accounting is black and white,” Deepika muses, wiping ladoo crumbs from her keyboard. “But really? It’s all shades of human.”

At OHI, every decimal tells a story—of heritage buildings reborn, desert dreams realized, and mothers balancing ledgers with lullabies. In the global real estate symphony, these accountants aren’t just keeping time—they’re composing the future.